By: Dorcas Wong, China Briefing, Dezan Shira & Associates

By: Dorcas Wong, China Briefing, Dezan Shira & Associates

On August 31, 2018, the second draft of the Individual Income Tax Law was passed. The new law makes changes to many elements of the calculation and enforcement of individual income tax (IIT) in China — focusing on expanding deductibles, adjusting tax brackets, and changing residency rules.

The aim of the new IIT law is to ease the tax burden for low to mid income earners while taking a tougher stance on both foreign workers and high-income earners.

As the cost of living in China has rapidly increased in recent years, the new IIT law offers some relief for lower income earners by reducing their tax burden.

This is also done through expanded tax deductions – including for children and the elderly – which come at a time when China’s population is rapidly aging and the government is encouraging families to have more children.

A day before the IIT law was passed, the State Council also announced RMB 45 billion (US$6.59 billion) worth of tax cuts. Both the tax cut and the IIT reform aim to boost consumption amid China’s escalating trade war with the US and signs of a slowing economy.

The new tax brackets and standard deduction amounts will take effect on October 1, 2018 while the remainder of the new personal income tax laws will come into force as of January 1, 2019.

China Briefing previously provided a full analysis of the first draft of the IIT law; however, the full effect of the IIT amendments — with its further revisions — are discussed below.

Here, we have summarized key changes that will affect the calculation and enforcement of IIT on comprehensive income. Please note that this article does not discuss income from operations, which are subject to different tax rates and calculations, in detail.

Calculation

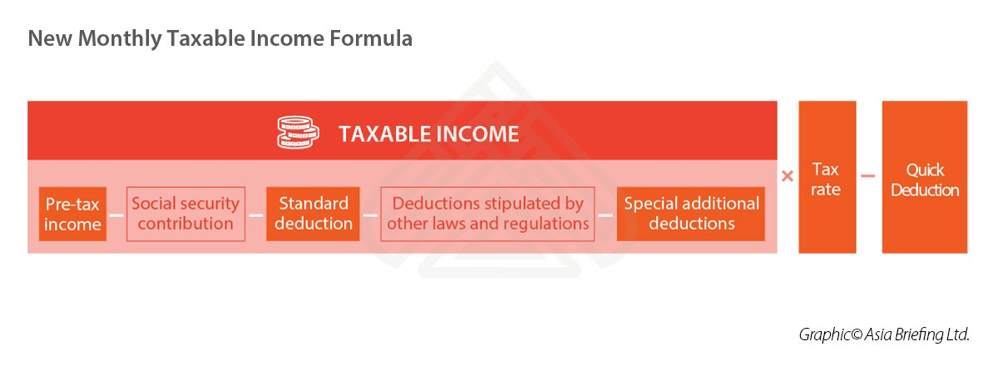

For simplicity of understanding, the formula to calculate IIT is provided below. The components that have been affected by the new law are highlighted.

Beginning October 1, 2018, the standard deduction on comprehensive income will increase from RMB 3,500 (US$512.1) for resident tax payers, and RMB 4,800 (US $702.3) for non-resident tax payers to a unified RMB 5,000 (US$731.6) per month.

This will raise the annual threshold to RMB 60,000 per year, which is equivalent to an extra annual deduction of approximately US$8,779.2 per year.

These changes will apply to residents and non-resident tax-payers.

New ‘special deduction’ category available

The new IIT Law also provides a new category of ‘special additional deductions’.

Under a revised Article 6, resident taxpayers will now be able to deduct the following additional items from their comprehensive income:

- Education expenses for children;

- Expenses for further self-education;

- Healthcare costs for serious illness;

- Housing loan interest;

- Housing rent; and

- Support for elderly (added in the final draft).

Charity deduction also now deductible

An individual who donates an amount (not exceeding 30 percent of their income) to charitable causes, such as education and poverty alleviation, can now deduct this from their taxable income.

Tax incentives for certain categories of income

The new IIT law now provides discount incentives for certain categories of income. Article 6 stipulates that the income derived from labor services, income from author’s remuneration, and income from royalties are to be calculated with a 20 percent discount before forming part of the monthly ‘pre-tax income’ (see formula above).

In addition to this, author’s remuneration will be subject to a further 30 percent discount to be applied on the monthly pre-tax income.

Tax cut skewed towards low to mid-income earners

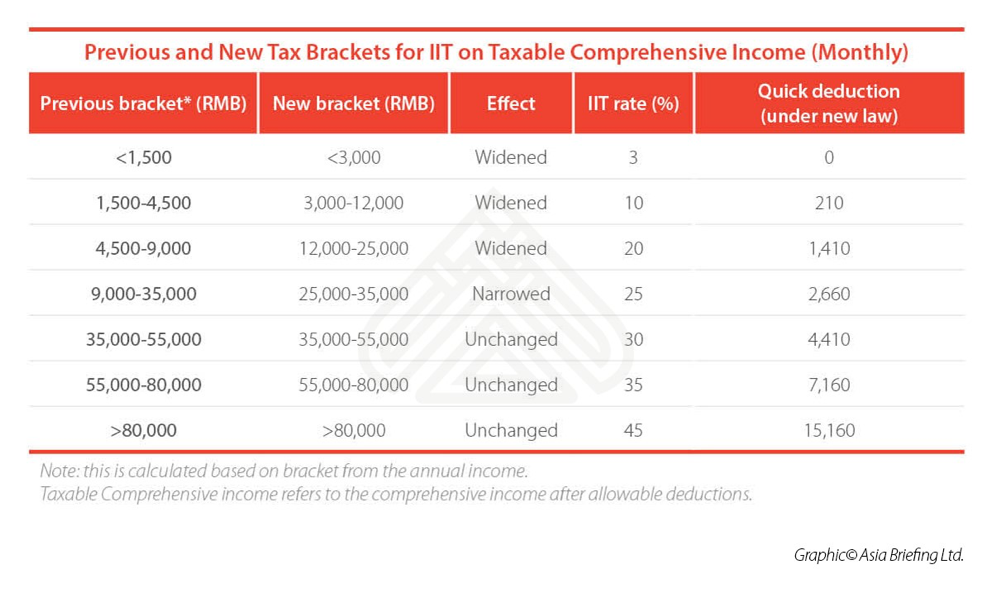

Beginning October 1, 2018, the new tax brackets shown below will take effect.

For comprehensive income: the lower tax brackets have been expanded. This means that the lower tax rates are now applied on a wider range of income levels, while the higher tax brackets remain the same.

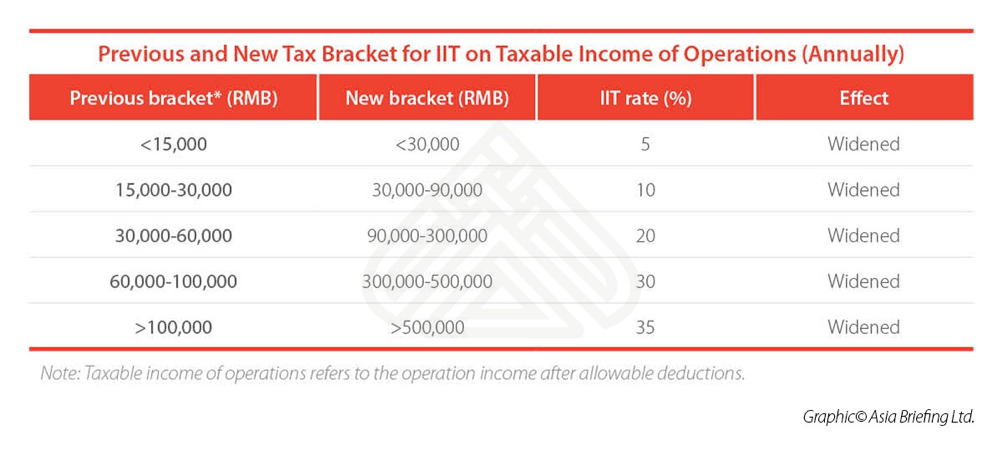

Similarly, the brackets for operation incomes have also been expanded to reflect the following:

Similarly, the brackets for operation incomes have also been expanded to reflect the following:

New consolidated categories of taxable income

New consolidated categories of taxable income

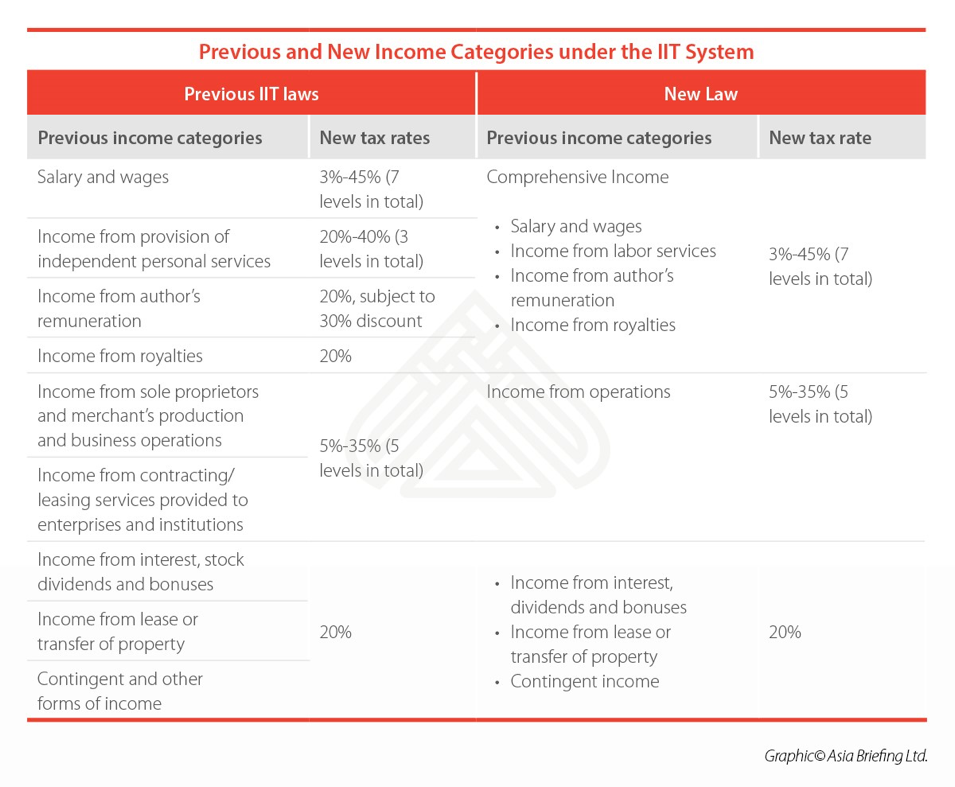

The categories of ‘income’ subject to IIT have now been simplified and amended under Article 2 of the IIT Law. The 3-45 percent progressive tax rate now applies to income derived from labor services, author’s remuneration, and royalties (collectively known as ‘comprehensive income’).

In effect, these three types of income that were traditionally taxed at a flat rate of 20 percent are now taxed at progressive rates according to the tax brackets.

See summary of changes in table below.

Expatriates now subject to ‘183-day-rule’ of residency

Expatriates now subject to ‘183-day-rule’ of residency

Article 1 of the IIT law deems that a foreign individual who resides in China for an accumulated 183 days or more in a year is considered a ‘tax resident’, and therefore subject to Chinese tax on their worldwide income.

This stipulation will replace the previous five-year-rule, under which a foreign individual was subject to Chinese taxation on worldwide income if they lived in China for more than five years.

This previous five-year threshold was easily circumvented by expatriates who would choose to leave the country for an aggregate of 91 days per year or more than 31 consecutive days to ‘reset the clock’ on the five-year threshold.

IIT liability for resident taxpayers now on an annual basis

Article 11 of the IIT law stipulates that, for tax residents, IIT will now be calculated on an annual rather than monthly basis.

However, withholding agents will continue to withhold the tax in advance on a monthly basis and non-residents will continue to pay tax on a monthly or subordinate basis.

Tax authorities given additional anti-tax avoidance powers

Article 8 provides tax authorities additional powers over tax avoidance schemes, particularly in relation to transactions involving non-arm’s length asset transfers and commercial arrangements where inappropriate tax benefits are derived.

Prepare for the transition

The IIT reform marks a significant change to China’s taxation policies. With the introduction of the new IIT law, low- and mid-income earners enjoy greater tax relief, while individual taxpayers of all stripes benefit from a broader range or deductibles.

At the same time, foreign workers may be taxed with greater scrutiny, and tax authorities have been given greater capabilities to enforce rules and expand tax collection.

Given the scope of the changes and the potential for closer regulatory scrutiny from tax authorities, businesses are advised to assess and implement relevant changes to their payroll policies in advance of the October 1 implementation date.

This article was first published by China Briefing which is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices in China, Hong Kong, Indonesia, Singapore, Russia, and Vietnam. Please contact info@dezshira.com or visit our website at www.dezshira.com.